Long-term business success in today’s competitive industry depends on having a solid understanding of a customer’s financial worth. Customer Lifetime Value (CLV) is one of the most effective indicators that can assist you in determining this value. In other words, CLV calculates the total revenue a customer will bring in for your company throughout their association with you.

This metric assists you in optimizing profitability in addition to providing useful information for marketing and customer service decisions. We’ll explore CLV in this blog, including its definition, significance, calculation methods, and ways to raise it.

Understanding Customer Lifetime Value

The total amount of money a client is anticipated to spend on your goods or services throughout their association with your brand is known as the customer lifetime value or CLV. CLV offers a longer-term perspective of client profitability than one-time transactions provide.

Definition and Concept

Client Lifetime Value (CLV) is all about understanding how much revenue a customer brings to your business over the entire period they stay with you, minus the costs involved in attracting and supporting them. Think of it as a snapshot of how valuable a client is to your business over time. CLV is essential because it helps you make smart decisions about your marketing budget, product development, and customer support, ensuring your company’s long-term financial health.

E-commerce: Knowing CLV is critical in the highly competitive world of online retail. Repeat business is the lifeblood of e-commerce companies, and CLV helps them determine which clients are most valuable over the long run. Knowing the lifetime value of a customer allows e-commerce businesses to:

- Target marketing efforts more effectively: Personalized marketing efforts, loyalty programs, and exclusive offers can help e-commerce enterprises retain high-value consumers rather than wasting enormous sums of money on customer acquisition.

- Optimize customer acquisition costs (CAC): E-commerce businesses may make sure their acquisition techniques are cost-effective by knowing the value of a customer over time and balancing CAC and CLV.

- Refine product recommendations: E-commerce companies can use CLV information to provide customers with more personalized product recommendations and boost the likelihood that they will make additional purchases based on past behavior and purchase history.

- Example: If a customer consistently purchases high-end electronics, targeted ads or offers for similar products can drive further engagement and increase CLV.

SaaS (Software as a Service): CLV is a crucial measure for subscription-based organizations, such as software as a service (SaaS) enterprises, as it has a direct impact on growth plans and revenue projections. Recurring revenue and client retention are crucial to various company models, and knowing CLV can be helpful in several ways:

- Pricing strategies: Pricing strategies: SaaS companies can modify their pricing models (e.g., tiered plans, and premium subscriptions) to maintain long-term profitability by understanding the average CLV of their customers.

- Example: The SaaS provider can provide enticing bargains that keep clients longer if the customer lifetime value (CLV) justifies delivering a discount for an annual subscription rather than a monthly one.

- Customer support and onboarding: SaaS providers can segment their clientele and provide more individualized support by using CLV data. Customers with high lifetime values (CLVs) could benefit from priority support or onboarding assistance to maximize product value and minimize attrition.

- Product development: SaaS companies can benefit from CLV data by using them to inform product enhancements or expansions that cater to customer preferences and help retain valuable customers over time.

- Example: A customer with a high CLV might appreciate tailored features or integrations that cater specifically to their needs, leading to improved satisfaction and retention.

Traditional Retail: Tracking CLV can help physical retailers as well by optimizing inventory and marketing strategies.

- Inventory management: Stores can stock products that are more likely to draw repeat business by knowing which products are purchased by high-value customers. This enables retailers to concentrate on the products that have the most long-term profitability impact and optimize inventory levels.

- Personalized marketing and promotions: Like online retailers, physical establishments can leverage CLV data to tailor loyalty plans, in-store experiences, and incentives to their most important consumers. Giving high-value consumers early access to new products or special in-store discounts, for instance, can strengthen your relationship with them.

- Customer retention strategies: Conventional merchants can create focused retention plans by utilizing CLV. For example, if a customer has a high CLV and hasn't been in the business lately, you could get them to come back by giving them targeted promos or invitations to special events.

- Example: A clothing retailer may identify that customers who buy both apparel and accessories have a higher CLV. By encouraging more customers to shop across categories, the retailer can drive long-term sales growth.

Why Customer Lifetime Value Matters?

Because Customer Lifetime Value (CLV) has a direct impact on long-term profitability and growth, organizations in a variety of industries need to understand and optimize CLV. Here are a few explanations of why CLV is important and how businesses might use it:

- Strategic Decision-Making

Businesses can spend more wisely on customer acquisition and retention when using CLV to guide their decisions. Knowing a customer's lifetime worth allows you to more wisely use your marketing budget:

- Acquisition costs: Companies are able to calculate the amount of money they can spend on attracting new clients without sacrificing their bottom line. A greater customer acquisition cost (CAC) is justified by a higher customer lifetime value (CLV), which eventually ensures a significant return on investment (ROI).

- Retention strategies: Rather than allocating too few resources to each customer, CLV assists in prioritizing efforts to keep high-value clients. Businesses can develop tailored experiences, loyalty programs, or targeted retention efforts to keep the most profitable customers engaged by concentrating on them.

- Example: If a customer’s CLV is significantly higher than average, you might allocate more of your marketing budget to keep them loyal through email marketing, personalized offers, or premium services.

- Customer Acquisition and Retention

To maintain profitability and balance customer acquisition costs (CAC), customer lifetime value (CLV) is essential. Any business model should carefully balance the revenue a customer will bring in throughout their engagement with the organization with the cost of acquiring new customers (CAC).

Maintaining this balance is essential because companies prosper over the long term when they regularly bring on new clients whose lifetime value greatly outweighs the initial outlay. CLV is crucial for controlling acquisition and retention for the following reasons:

- CLV and CAC: Finding the Right Balance

The CLV has to be greater than the CAC in order to guarantee profitability. The 3:1 ratio is a straightforward guideline that states that a customer's lifetime value should ideally be three times their acquisition cost. With this margin, companies can still turn a profit while paying for operating and acquisition costs.

- Example: Imagine your company spends $100 to acquire a customer (CAC), but this customer generates $500 in revenue over their lifetime (CLV). The 5:1 CLV to CAC ratio means that you’re not only recovering the acquisition cost but also earning $400 in profit. This is an ideal situation where the business can grow sustainably, knowing that each customer brings in more revenue than what was initially invested in acquiring them.

- CLV for Smart Acquisition Strategies

Businesses can make more informed investments in client acquisition efforts by knowing the CLV. Businesses can concentrate on high-value channels or campaigns that draw clients with a higher CLV by making data-driven decisions.

Targeted marketing: Even though the initial CAC is slightly higher, you can increase your investment on a certain marketing channel if you know it consistently brings in high-CLV clients. You’ll have faith that these clients will eventually pay off.

Optimizing acquisition channels: Companies might focus on channels that generate greater CLV customers in order to modify their acquisition efforts. Paid advertisements, for instance, may attract more devoted clients with a better CLV than organic efforts, but they may also have a higher CAC.

This makes it possible for companies to efficiently allocate their marketing expenditure. By continuously measuring and optimizing CAC relative to CLV, businesses can build acquisition strategies that ensure both immediate gains and long-term profitability.

- CLV and Retention: Maximizing Customer Value

While gaining new clients is vital, keeping existing ones is frequently more profitable and efficient. Given that returning customers are more likely to be devoted and provide more income over time, retention measures are essential for optimizing CLV.

Loyalty programs: By promoting recurring business, customer loyalty programs, customized discounts, and improved customer service can raise CLV. For instance, an online retailer may provide special discounts to clients on their third or fourth purchase to encourage repeat business.

Improving retention with data: Businesses can also use CLV to determine when a customer is likely to leave. Businesses can use proactive retention techniques, including tailored marketing campaigns or offers, to keep high-value customers engaged by utilizing predictive analytics based on CLV patterns.

In the end, achieving a balance between CAC and CLV guarantees that companies aren’t splurging on client acquisition without realizing a return on their investment. Through client retention and lifetime value optimization, businesses may boost their bottom line and foster sustainable expansion.

- Financial Forecasting and Planning

Customer lifetime value is an essential indicator for business planning and financial forecasting in addition to being a useful marketing tool. Businesses may more accurately forecast future cash flow by knowing how much each client will bring in over the course of their relationship, which enables them to make well-informed decisions regarding long-term growth strategies, investments, and budgeting. CLV aids in financial planning and forecasting in the following ways:

- Revenue Forecasting

Businesses can more accurately forecast future revenue streams thanks to CLV. Businesses can project their future revenue based on their existing client base by knowing the lifetime value of each customer. This aids businesses in making well-informed financial decisions about everything from planned expansion to operational spending.

- Example: Let’s say your SaaS company has 1,000 customers, and the average CLV for each customer is $2,000. This allows you to forecast $2 million in future revenue from these customers alone, even if you don’t acquire new customers for a while. With this information, you can plan your cash flow, manage expenses, and decide when to reinvest in growth or new product development.

Investment decisions: When and where to invest can be determined by your predicted revenue. Businesses can spend in areas like product innovation, marketing expansion, or hiring new staff with confidence and without worrying about financial instability if they know they will have a consistent flow of income for the upcoming year.

- Budget Allocation

Companies can more efficiently distribute their funds by using CLV data. Companies can focus their expenditure on areas that will yield the most return by knowing which customers or customer segments have the highest lifetime value.

Marketing budget: Businesses can focus more of their marketing money on channels that draw in high-CLV clients rather than spreading it thinly across all acquisition channels. The company can allocate more funds to social media if, for example, email marketing consistently produces consumers with a CLV of $200 while social media advertisements consistently produce customers with a CLV of $500.

Customer service and retention: To maintain satisfied and devoted high-CLV consumers, businesses should also devote resources to enhancing customer service, providing greater customer support, and putting tailored engagement methods into practice.

- Long-Term Financial Stability

Through the integration of CLV into financial forecasting, enterprises may strategize for sustained expansion and stability. A clearer view of the company's future financial health is provided by CLV, which offers information on how long clients are expected to stay with the organization and how much income they will contribute over time.

Planning for growth: For instance, a company that relies on subscriptions would observe an increase in average CLV as a result of high rates of client retention and satisfaction. This suggests that the business can grow with confidence since it knows that its present clientele will keep bringing in steady income.

Risk management: On the other hand, if a company observes a downward trend in CLV, it can act quickly to resolve the problem before it has a detrimental effect on sales. Maybe the rate of customer attrition is higher than anticipated, or marketing initiatives are drawing in lower-value clients. Businesses should modify their plans to avoid risk and guarantee long-term success by recognizing these patterns early on.

How to Calculate Customer Lifetime Value?

Calculating CLV can vary in complexity, but here’s a basic overview:

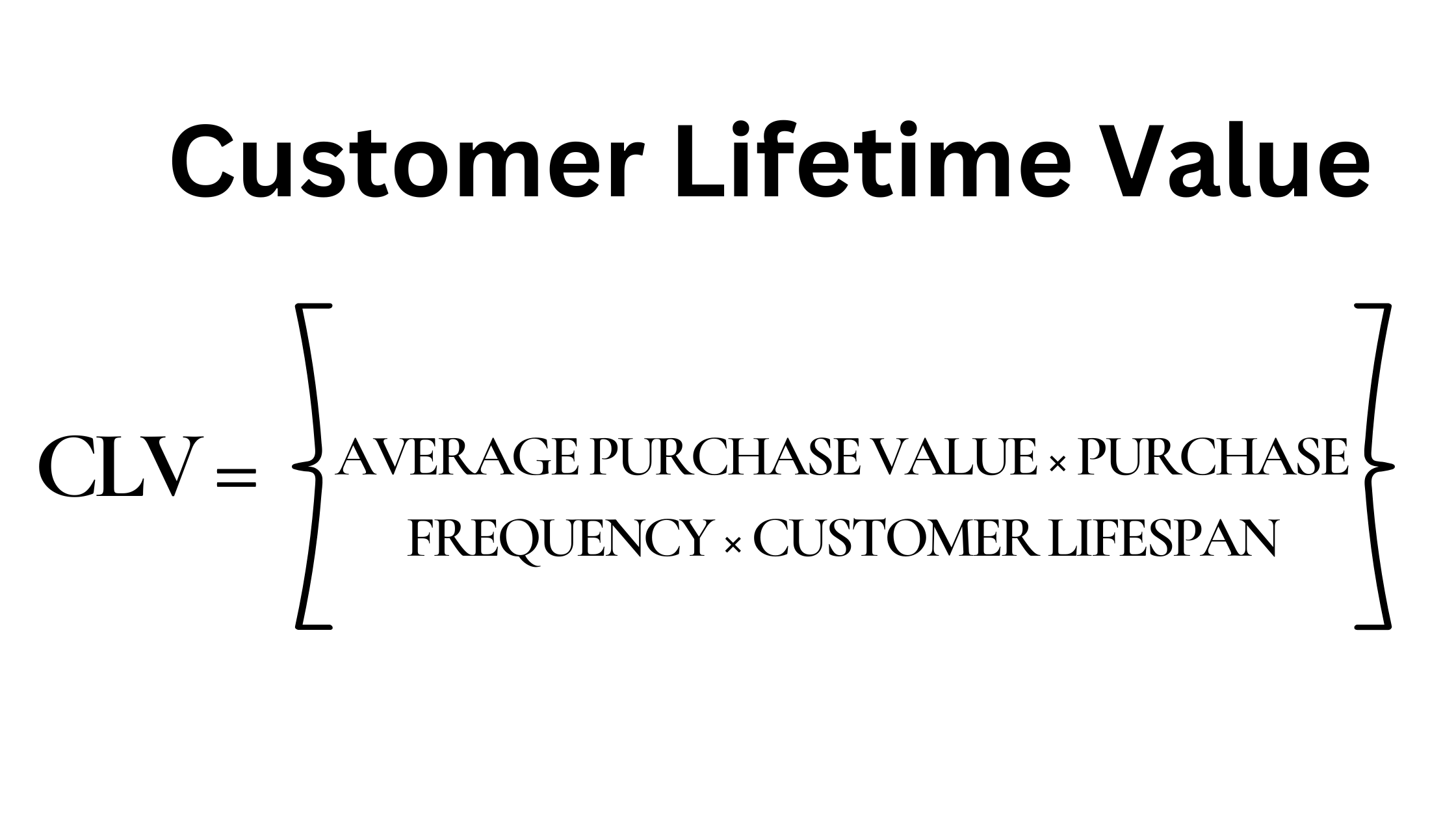

- Basic CLV Formula

The simplest formula for CLV is: CLV=Average Purchase Value×Purchase Frequency×Customer Lifespan

- Average Purchase Value: Total revenue divided by the number of purchases over a specific period.

- Purchase Frequency: How often a customer purchases within that period.

- Customer Lifespan The average duration (in years, months, etc.) a customer continues to buy from your business.

Example: Let’s say an online store has the following data:

- Average Purchase Value: $50

- Purchase Frequency: 4 times a year

- Customer Lifespan: 5 years

Calculating CLV:

CLV=50×4×5=1000\text{CLV} = 50 \times 4 \times 5 = 1000CLV=50×4×5=1000

In this case, the customer is worth $1,000 over their lifetime.

- Advanced Calculation Techniques

For more precise calculations, businesses can use cohort analysis or predictive modeling, taking into account factors like seasonality, customer churn rates, and changes in buying behavior.

- Common Pitfalls in CLV Calculation

Many businesses fail to account for churn rates, which can lead to inflated CLV estimates. Additionally, ignoring external market factors can skew results.

Key Factors Influencing Customer Lifetime Value

Comprehending the variables that impact Customer Lifetime Value (CLV) is imperative for refining commercial tactics and enhancing sustained profitability. Customer lifetime value (CLV) is a dynamic metric that varies over time according to a range of internal and external factors that influence a customer's spending patterns. Businesses can enhance their overall revenue by implementing focused methods to increase CLV by assessing and resolving these issues. The following are the main factors that have a big influence on CLV:

- Customer Behavior and Purchase Patterns

One of the main factors influencing CLV directly is customer behavior. This comprises variables including the frequency of a customer's purchases, the typical amount of each transaction, and the length of time the customer stays devoted to a particular brand. By comprehending and forecasting these actions, companies may adjust their tactics to improve customer lifetime value.

- Average Order Value (AOV): Customers' lifetime value is directly influenced by the amount they spend on each transaction. By upselling or cross-selling more expensive goods and services to customers to raise the AOV, businesses can raise CLV. An online retailer might, for instance, recommend related items to clients at the point of checkout to encourage them to spend more money on a single item.

- Frequency of Purchases: The frequency of a customer's purchases over time has a direct impact on CLV. Recurring purchase encouragement can greatly increase CLV. Businesses can entice customers to make more regular purchases by offering limited-time discounts, loyalty programs, and subscription services. A subscription box service that, for instance, gives out free presents after three months in a row can encourage customers to make more purchases, which raises CLV.

- Predictive Analytics: Businesses can use data analytics technologies to forecast future sales based on past customer behavior. Analytics can be used to find trends in consumer preferences, purchase seasons, and even churn risk. Businesses can create tailored marketing tactics to maintain client engagement with the help of these insights. For instance, if analytics show a decline in a customer's involvement, a timely discount offer or customized product suggestion can entice them to come back.

- Customer Retention Strategies

It is frequently less expensive to keep existing clients than to find new ones. By retaining clients for longer periods of time, strong customer retention initiatives can significantly increase CLV. Retention-focused businesses often enjoy higher overall income since loyal customers tend to spend more money over time.

- Loyalty Programs: One of the best methods to boost retention and, in turn, CLV is to provide prizes to devoted clients. Customers who participate in loyalty programs are more likely to make more purchases, spend more money, and show interest in the brand. A coffee shop might, for instance, provide a complimentary drink for every ten purchases, enticing patrons to come in more often in order to benefit from the offer.

- Personalized Engagement: ustomizing offers and communications to each customer's preferences can improve retention. Businesses can demonstrate their appreciation for their customers by offering birthday discounts, product recommendations based on past purchases, and personalized email campaigns. This increases the likelihood that the consumer will remain by fostering a closer relationship with them.

- Proactive Customer Support: Providing outstanding customer service is another important aspect of keeping consumers. Prompt and competent support can decrease churn and increase loyalty by transforming potentially negative experiences into positive ones. For example, a SaaS provider that provides round-the-clock customer service and promptly fixes technical problems can keep customers who otherwise might have terminated their subscriptions.

- Customer Experience

Providing outstanding customer service (CX) is another important element that affects CLV. Customer satisfaction may be significantly raised by providing a nice experience at every touchpoint, including during a purchase, when interacting with customer service, and through tailored marketing initiatives. This will eventually result in increased spending and loyalty from customers.

- Consistency Across Channels: Whether they are purchasing online, through a mobile app, or in-store, customers want a flawless experience. Providing a seamless, uniform experience over all channels helps increase client retention. For instance, a fashion retailer is likely to retain repeat business if it provides the same customized attention both online and in-store.

- Emotional Connection: Brands that create an emotional connection with their customers can increase loyalty and retention, which positively impacts CLV. This could be achieved through a brand’s messaging, values, or how they make customers feel during interactions. A brand like Apple, for instance, fosters a strong emotional connection by consistently delivering innovative products and a premium experience, resulting in high customer loyalty and retention.

- Resolving Pain Points: Improving the customer experience also greatly depends on efficiently addressing the problems that customers face. Businesses may enhance customer experience (CX) by streamlining interactions, which can include providing flexible return policies, streamlining the checkout process, and optimizing website navigation. For instance, a big part of Amazon's high CLV can be attributed to its simple, one-click checkout process and convenient return policies.

- Post-Purchase Experience: The point of sale is not where the relationship with the customer ends. Customers can be engaged and encouraged to make additional purchases with a good after-purchase experience, which includes targeted offers for related products, follow-up emails, and product care advice. For example, a high-end watch company may provide free maintenance services following the sale to entice the consumer to come back for more goods or services.

- Customer Satisfaction and Brand Loyalty

Customers who are happy with a business are more likely to suggest it to others, come back, and make more purchases. Brand loyalty is a result of high customer satisfaction, and brand loyalty raises CLV. Companies can increase lifetime value by cultivating loyalty among their clientele by always providing high-quality goods and services and going above and beyond their expectations.

- Net Promoter Score (NPS): Utilizing metrics such as Net Promoter Score (NPS) to measure customer satisfaction enables organizations to assess client loyalty and pinpoint areas in need of development. A high net promoter score (NPS) suggests that consumers are not only content but also inclined to tell others about the brand, which can boost CLV and referrals.

- Advocacy and Referrals: Loyal, satisfied consumers frequently act as brand ambassadors, bringing in new business. This is something that a referral program may take advantage of, encouraging devoted clients to recommend new clients, thereby increasing CLV. For each successful referral, a SaaS provider might, for instance, provide a discount on a subsequent subscription, raising the CLV of both the new client and the referring customer.

Strategies to Enhance Customer Lifetime Value

Improving Customer Lifetime Value (CLV) is crucial to maintaining the long-term viability and expansion of your company. Businesses can gradually improve the amount of money they make from each customer by concentrating on tactics that encourage customer retention, repeat business, and closer customer connections. The following are a few thorough and practical methods to raise CLV:

- Improving Customer Experience

One of the easiest methods to raise CLV is to provide a great customer experience (CX). Customers are more likely to return, spend more, and refer others to your business when they have a seamless, pleasurable experience with it.

- Seamless Shopping Experience: Whether making a purchase in-person or online, make sure it's simple, straightforward, and hassle-free. This includes websites that load quickly, straightforward navigation, simple payment options, and return policies that are clear. Customer happiness and loyalty can be significantly increased by lowering friction at any touchpoint.

- Customer Service Training: Spend money on thorough training in customer service. Skilled customer service representatives can quickly and effectively handle consumer problems, transforming potentially bad encounters into pleasant ones. Good customer service promotes repeat business and strengthens loyalty.

- Example: Zappos, renowned for providing excellent customer service, has developed a devoted clientele by going above and beyond in every encounter.

- Proactively Seeking Feedback: To find areas for improvement, collect and act upon client feedback regularly. To learn more about your customers' problems, send them questionnaires after they've made a purchase, get feedback, or interact with them on social media. Customers are more inclined to stick around when they see that their opinions are respected and used to make improvements. For instance, to guarantee customer pleasure and enhance services, Amazon regularly requests feedback from customers following a purchase.

- Implementing Loyalty Programs

One of the best ways to improve client retention and, in turn, CLV is through loyalty programs. They use prizes or other perks to entice clients to make additional purchases.

- Rewards for Recurring Purchases: After a certain number of purchases, loyalty programs can award points, discounts, or free merchandise. A coffee establishment might, for instance, give away a free drink for every ten purchases. This promotes brand loyalty in addition to urging return visits. One excellent example is Sephora's Beauty Insider program, which provides members with access to exclusive products and rewards for purchases, thereby fostering customer loyalty and engagement.

- Tiered Loyalty Programs: Creating tiered loyalty programs that allow users to spend more to access better incentives can help promote recurring business. Customers are more likely to feel rewarded and come back when they spend more money. For example, passengers who attain higher tiers in airline frequent flyer programs generally receive additional privileges like priority boarding or free upgrades.

- Exclusive Offers for Loyal Customers: By providing exclusive discounts, early access to new products, or VIP customer care, you may increase customer retention by making your devoted clients feel valued and appreciated. This is particularly useful for high-value clients who make a substantial contribution to your CLV.

- Personalization in Marketing

Customized marketing initiatives that are based on the tastes and past purchases of the target audience can increase engagement and conversion rates dramatically. Sending tailored emails with product recommendations, for example, may boost sales.

- Tailored Product Recommendations: Customized product recommendations that are based on browsing history or previous purchases may encourage more purchases. For instance, AI-driven algorithms are used by e-commerce giants like Amazon to suggest goods that customers are likely to purchase, thus improving the value and frequency of their orders.

- Segmented Email Campaigns: Email marketing that is segmented and tailored according to the buying habits, preferences, or demographics of your customers can increase engagement. Customers may be encouraged to make larger purchases by receiving personalized emails with discounts, special offers, and recommendations for related products. An email from a fashion company, for instance, can offer new arrivals that are comparable to what a consumer has already purchased.

- Customized Content: A closer relationship with your audience can be achieved by producing individualized content, such as blogs, videos, or social media posts based on the interests of your customers. For instance, depending on the kind of pet a customer has, a pet supply shop may give customized care recommendations and purchase recommendations.

- Engaging Communication

Keeping in touch with consumers regularly fosters relationships and keeps them interested in your business. Customers are more inclined to stick with you and make additional purchases when they feel connected, which raises CLV.

- Regular Newsletters: Customers are informed and engaged when regular email newsletters featuring important content—like product updates, industry news, advice, or promotions—are sent out. This can also act as a subtly helpful reminder to buy something. To keep customers interested and excited, a tech company could, for example, send out monthly newsletters with updates about new features and products.

- Follow-Up Emails: Sending clients follow-up emails after a transaction demonstrates your concern for their happiness. These emails may contain surveys, instructions for maintaining the product, or recommendations for similar goods. To encourage repeat business, a furniture company can, for instance, send a follow-up email with maintenance advice and recommendations for related items after a customer makes a purchase.

- Social Media Engagement: Using social media to actively engage with customers can help create a brand community. Maintaining a sense of connection with customers can be achieved by engaging in conversations, sharing user-generated content, and responding to comments. For example, Starbucks uses social media to interact with consumers, hear their opinions, and provide special offers to create enduring relationships that raise CLV.

- Cross-Selling and Upselling

Upselling and cross-selling are two powerful techniques for raising average order value, which raises CLV. Businesses can increase the amount of money they make from each consumer by enticing them to purchase more or higher-value goods.

- Cross-Selling: This entails suggesting related goods or services. A buyer of a laptop, for instance, can be presented with extra peripherals like a mouse, a laptop case, or an extended warranty. The "frequently bought together" feature on Amazon is a great illustration of how cross-selling may boost AOV and CLV.

- Upselling: Another strategy to raise AOV is to persuade consumers to purchase a more expensive or high-end version of a product they are contemplating. To increase customer happiness and CLV, a software company could, for example, provide a basic plan with the option to upgrade to a premium plan with more features.

- Subscription and Membership Models

By guaranteeing a consistent revenue stream from clients over time, using a subscription or membership model helps increase CLV. This tactic is especially effective for companies that provide consumable products or services.

- Subscription Services: By encouraging repeat business, giving consumers the choice to subscribe to receive goods or services regularly (e.g., monthly boxes or auto-renewal for services) boosts their lifetime value. For instance, Dollar Shave Club increased CLV and produced a steady income stream by basing its business on razor and grooming goods subscriptions.

- Membership Programs: Paid membership programs can increase customer loyalty and raise CLV. In these programs, customers pay for special privileges (such as free delivery or early access to sales). For instance, because of benefits like free shipping and access to unique content, Amazon Prime members are more likely to purchase more frequently and spend more money.

- Reducing Churn Rate

One of the main risks to CLV is churn or the loss of revenue from clients. Customer retention and, by extension, CLV can be greatly increased by putting churn reduction tactics into practice.

- Proactive Customer Support: Proactive support, like live chat or round-the-clock customer service, helps to address problems before they become churn-causing. To lower the possibility of cancellations, a SaaS provider might, for instance, get in touch with customers who haven't checked in for a while to give support.

- Predictive Analytics to Identify At-Risk Customers: Businesses can step in with tailored offers or support to consumers who are about to churn by using predictive analytics to identify those clients. For example, offering a special discount or conducting personal outreach to a client who has stopped using a service could get them back, minimizing churn and increasing CLV.

Client lifetime Value (CLV) measurement is essential for figuring out how profitable your client base will be in the long run and for optimizing methods to grow it. There are numerous tools and resources available to assist firms in tracking, calculating, and analyzing CLV. These technologies offer additional insights into customer behavior, retention, and general business health in addition to CLV indicators. Here's a thorough examination of some of the most popular instruments and sources for calculating CLV:

Here are the top 4 tools for measuring Customer Lifetime Value (CLV):

- Google Analytics

Estimating CLV is made easier with the support of Google Analytics, which provides robust tracking and insights into customer activity. It monitors important indicators such as average order value, frequency of purchases, and cohort behavior, which enables companies to assess the long-term profitability of their clientele.

- Key Features

- Online shopping Tracking: Gathers transaction information for use in calculating CLV.

- Cohort analysis examines the performance of different client segments over time.

- Determines which marketing channels bring in high-CLV clients with attribution modeling.

- Ideal For: Online retailers who want to monitor consumer activity and calculate CLV.

- HubSpot CRM

Calculating CLV is made simpler with the help of HubSpot CRM's extensive customer relationship management features, which keep track of transactions and interactions. The platform creates a comprehensive picture of the consumer by integrating data from sales, marketing, and customer support.

Key Features

- Revenue Attribution: Uses revenue from specific clients to determine CLV.

- Segmentation: Enables companies to target their marketing by grouping clients based on CLV.

- Custom Reports: Tailored analyses of business performance and customer value.

- Ideal For: Businesses looking for a feature-rich CRM system with integrated CLV tracking.

- Lifetimely (Shopify App)

Lifetimely is a specialized tool made to compute CLV for Shopify users. For e-commerce companies that depend on recurring business, it offers real-time CLV indicators based on past purchase data.

Key Features

- Automated CLV Calculation: information on lifetime profitability and rates of recurring business.

- Cohort analysis: Monitors a customer group's cumulative CLV.

- Ideal For: Shopify retailers looking for a user-friendly CLV tracking solution.

- Baremetrics

Because Baremetrics computes CLV automatically from subscription data, it is ideal for subscription-based enterprises. Being able to deliver insightful data on revenue, average customer value, and attrition makes it a crucial tool for SaaS organizations.

Key Features

- Automatic CLV Calculation: This method uses the recurring income to track CLV in real-time.

- Churn Insights: Examines how churn affects CLV and client retention.

- Cohort Reports: Monitor the long-term value contributions made by various client segments.

- Ideal For: Companies that rely on subscriptions and want to maximize client value and retention.

Real-World Examples and Case Studies

- Spotify: Using CLV for Customer Segmentation

Spotify successfully segments its user base through the use of Customer Lifetime Value modeling. Spotify develops marketing techniques that are specifically targeted at its user base by examining parameters such as engagement levels and length of subscription. For instance, they provide free trials or tailored recommendations to boost user retention and generate income over the long run. By prioritizing higher-value clients, they can increase customer happiness and loyalty through the usage of CLV. In addition to increasing overall CLV, this segmentation aids in identifying customers who are most likely to switch from free to premium memberships.

- Starbucks: The Power of Customer Satisfaction

Starbucks has successfully raised its Customer Lifetime Value through a customer-centric approach. Starbucks uses its mobile app to deliver targeted offers and reward programs that keep customers interested and promote return business. A 5% improvement in client retention can result in a 25% to 95% increase in revenue, per a Bain & Co. study. Starbucks takes advantage of this by providing customized rewards based on past purchases, encouraging more frequent purchases and greater brand loyalty, and ultimately achieving a computed CLV of $14,099 per customer.

- Netflix: Leveraging Data to Increase Retention

Netflix employs customer lifetime value (CLV) data to enhance customer retention via tailored content suggestions. Netflix reduces churn and increases happiness by customizing its platform to individual viewing tastes through the analysis of user data. Netflix maximizes revenue produced per subscriber as more people stay subscribed for longer periods. To further increase client lifetime value, the business uses this data to forecast when a customer could cancel and provides incentives or tailored content to entice them to stay.

- McDonald's: Driving CLV through Digital Transformation

Through loyalty programs and smartphone ordering, McDonald's has engaged customers through digital channels to increase CLV. Their mobile app makes it possible to customize promos and offers, giving returning customers a unique experience. McDonald's keeps track of customer behavior to provide timely promotions that encourage return business and dramatically increase CLV. Their emphasis on keeping customers through digital channels has worked well to keep them loyal and raise average customer spending.

Conclusion

Customer Lifetime Value is an important statistic that must be taken into consideration. Gaining insight into and maximizing CLV can help you make more profitable strategic decisions and enhance client retention. Businesses are able to leverage the power of CLV to promote growth and long-term success by putting these tactics into practice.

By understanding the factors that influence CLV, companies can tailor their marketing efforts, improve customer experiences, and increase overall profitability. Focusing on long-term relationships rather than short-term gains ensures customer loyalty and enhances the lifetime value of each client.

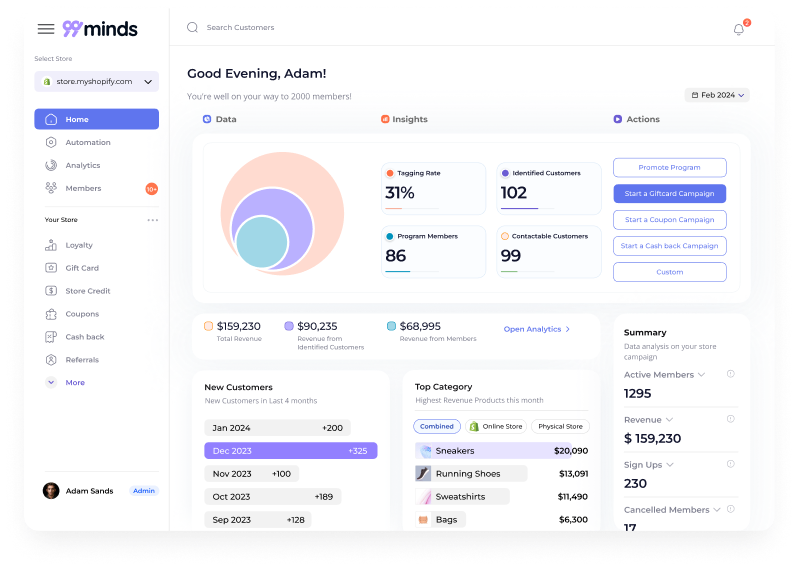

Moreover, investing in the right tools, such as those provided by 99minds, to measure and monitor CLV allows businesses to continuously optimize their strategies and identify new opportunities for growth.

Ultimately, mastering CLV helps you not only understand the true value of your customers but also unlocks the potential to foster sustainable, scalable business success in an increasingly competitive marketplace. With solutions like 99minds, businesses can streamline their efforts to maximize CLV and achieve lasting growth.

Frequently Ask Questions (FAQs)

What constitutes a good CLV?

A good CLV varies by industry, but generally, it should significantly exceed your Customer Acquisition Cost (CAC). A common benchmark is aiming for a 3:1 ratio (CLV to CAC).

How often should businesses reassess their CLV calculations?

Businesses should reassess CLV calculations regularly, ideally quarterly or semi-annually, to account for changes in customer behavior and market conditions.

Can CLV be applied to different customer segments?

Absolutely! Analyzing CLV by different customer segments can provide valuable insights, allowing businesses to tailor marketing strategies to maximize returns from each segment.