In today’s dynamic financial landscape, bank loyalty programs have become essential tools for fostering deeper customer relationships and enhancing the overall banking experience. These programs are not just about rewarding transactions; they are strategic initiatives designed to build trust, offer personalized services, and encourage long-term loyalty.

Recent trends indicate a significant shift in how banks approach customer engagement. A report from the American Bankers Association highlights that marketers’ top objective is deposit growth, achieved through new customer acquisition, deepening existing customer relationships, and improved retention. Furthermore, a study by Mintel reveals that 77% of banking consumers expect to be rewarded for their loyalty, prompting financial institutions to expand both the range and relevance of their offerings.

In 2025, the focus is on creating programs that offer diverse rewards and personalized experiences. For instance, some banks are providing cashback, travel benefits, and exclusive privileges to enhance customer satisfaction and retention.

As the market for bank loyalty programs continues to grow, with projections estimating a reach of USD 1,507.10 million by 2028, financial institutions are increasingly recognizing the importance of these programs in building lasting customer relationships.

In this article, we will explore the top 10 bank loyalty programs in 2025, showcasing how these innovative strategies are transforming customer engagement and setting new standards in the banking industry.

How Bank Loyalty Programs are Shaping the Future of Banking

The banking industry has weathered countless changes over the centuries, enduring global crises, technological advancements, and shifts in consumer behavior. For a long time, it seemed that traditional banks were immune to the wave of digital transformation sweeping through other sectors. However, the rise of fintech and new customer expectations is now challenging that status quo.

As technology continues to evolve, along with changing demographics and a redefined understanding of customer experience, fintech is becoming more mainstream. The COVID-19 pandemic accelerated this transformation, with fintech app usage jumping by 73% as consumers turned to digital solutions for everyday banking.

Challenger banks like Monzo and Revolut have been at the forefront of this shift, offering seamless digital-first experiences that have resonated particularly with Millennials and Gen Z. These younger generations, who are more digitally native and financially savvy, are increasingly viewing traditional banks as outdated. In fact, Gen Z is now the most financially influential generation, surpassing Millennials as the world’s most powerful consumer group.

As a result, traditional banks are facing immense pressure to innovate and retain customers in the face of growing competition. The rise of decentralized financial solutions, such as embedded banking and digital lending, is further eroding the traditional banking revenue model. To stay relevant, banks must adopt new strategies, like bank loyalty programs, to maintain customer loyalty and compete with the more agile fintech players. Holding on to traditional methods alone is no longer viable, as digital currencies and other innovations continue to draw money away from the conventional banking system. Banks must find ways to evolve, offering more personalized, rewarding experiences to keep customers engaged and attract new ones.

Building Loyalty in Banking with Reward Programs

The pandemic has drastically reshaped customer expectations, particularly in the banking sector. As we emerge from a period of crisis, it has become clear that simply providing basic services is no longer enough to ensure customer satisfaction and loyalty.

In the past, loyalty was often built through transactional relationships, but the pandemic has created a shift in consumer behavior. According to Forrester, a leading customer research firm, the pandemic has led to the rise of a new kind of customer, one who is not just rational but also emotionally driven. These customers expect a personalized, empathetic approach from the brands they engage with, including their bank. As Forrester’s research emphasizes, it’s not enough to offer a product; customers now demand products that resonate with their needs and lifestyle.

This shift is especially significant among younger generations such as Millennials and Gen Z, who prioritize authentic brand experiences and personalization, whether they’re shopping or banking.

This transformation marks a critical moment in banking, as Accenture notes. To remain competitive, banks must evolve and build meaningful relationships with their customers, especially in the face of fintech challengers that offer seamless, personalized experiences and innovative loyalty programs.

Moreover, according to the Deloitte Employee Survey, establishing loyalty in the banking sector is particularly challenging compared to other industries. The importance of customer loyalty has never been clearer, and many banks are increasingly turning to bank loyalty programs to strengthen customer engagement. Research shows the positive impact of loyalty schemes:

- According to Collinson, 70% of customers say that rewards from financial institutions influence their decisions

- 20% would be more likely to spend more if offered personalized rewards.

- Referrals, according to Harvard Business Review, lead to 15% more profits.

- A KPMG survey revealed that 61% of customers think it is crucial for banks to develop innovative ways of rewarding loyal customers.

These statistics demonstrate that loyalty programs are no longer just an added bonus, they are a strategic necessity for banks looking to provide superior customer service and stay ahead of evolving expectations. Whether through cashback, exclusive perks, or interest rate boosters, ensuring customers feel valued is now a central focus.

Below, we explore examples of banks successfully implementing innovative bank loyalty programs to attract and retain their customer base.

Types of Bank Loyalty Programs

Bank loyalty programs come in various forms, each crafted to cater to the diverse needs of customers. Here’s a breakdown of the key types of bank reward programs that can help consumers make informed choices:

Points-Based Reward Programs

- Customers earn points with each transaction.

- Points can be redeemed for a variety of rewards, offering flexibility.

- Allows customers to choose rewards based on personal preferences.

Tiered Reward Programs

- Benefits increase as customers reach higher loyalty or spending levels.

- Direct cash rewards can be earned for qualifying transactions.

- Encourages continued engagement and loyalty through tier advancements.

Cashback Reward Programs

- Customers earn a percentage of cash back on their purchases.

- Cashback can be applied to credit services or other benefits.

- Provides immediate, tangible rewards for everyday purchases.

Coalition Loyalty Programs

- Partnerships with other businesses or financial services expand reward options.

- Offers a variety of rewards like coupons, charity donations, or discounts at partner stores.

- Examples include unlimited free ATM transactions and discounts at affiliated retailers.

Digital Wallet-Based Programs

- Integrates with digital wallets for an easy, seamless experience.

- Allows customers to accumulate and redeem rewards digitally.

- Simplifies the process using modern technology solutions.

By understanding the different types of bank loyalty programs, customers can select the one that best fits their spending habits, preferences, and long-term financial goals. Whether it’s flexibility, immediate rewards, or exclusive benefits, there’s a program designed for everyone.

Key Steps for Implementing Effective Bank Loyalty Programs

Creating a successful bank loyalty program involves several strategic steps that are crucial for its success. These steps go beyond initial implementation and require constant refinement to stay aligned with customer needs and market changes. Here’s an in-depth look at the essential steps in implementing a bank loyalty program that thrives over time.

Deep Understanding of Customer Needs

Crafting a Solid Commercial Model

Personalizing Offerings for Diverse Segments

Ensuring Long-Term Support

Staff Training and Channel Support

Collaborating with Non-Competing Partners

By following these steps and constantly refining the program to meet customer needs, banks can create a loyalty program that fosters stronger customer relationships and drives long-term growth. Staying flexible, responsive, and customer-centric is the key to ensuring that a bank loyalty program remains relevant and effective in today’s competitive banking landscape.

Top 10 Leading Bank Loyalty Programs

Citi ThankYou Rewards

Key Benefits:

- Points per Dollar Spent: Earn 1 point for every $1 spent, with bonus points for select categories.

- Flexible Redemption Options: Points can be redeemed for merchandise, travel, gift cards, or cash, offering diverse reward choices to meet customer preferences.

- 10% Points Back on Redemptions: Get 10% of points back on redemptions (up to 100,000 points) for increased value.

Exclusive Features:

- Varied Categories for Bonus Points: Certain categories, such as dining, entertainment, and travel, provide enhanced point accrual, encouraging members to focus on high-reward spending areas.

- Dedicated Member Account: Points are accumulated in a centralized account for easy tracking and redemption, ensuring a seamless customer experience.

- Travel Perks: Citi ThankYou members can use their points for travel rewards, including flights, hotel stays, and car rentals, enhancing the program's appeal for frequent travelers.

- Access to Exclusive Offers: Members can access special promotions, limited-time deals, and travel-related perks to further enhance the loyalty experience.

- Program Versatility: Citi ThankYou provides a wide array of redemption options that are adaptable to both short-term and long-term goals. The points-back feature on redemptions ensures that the value of rewards goes further, while the variety of reward types appeals to different types of consumers.

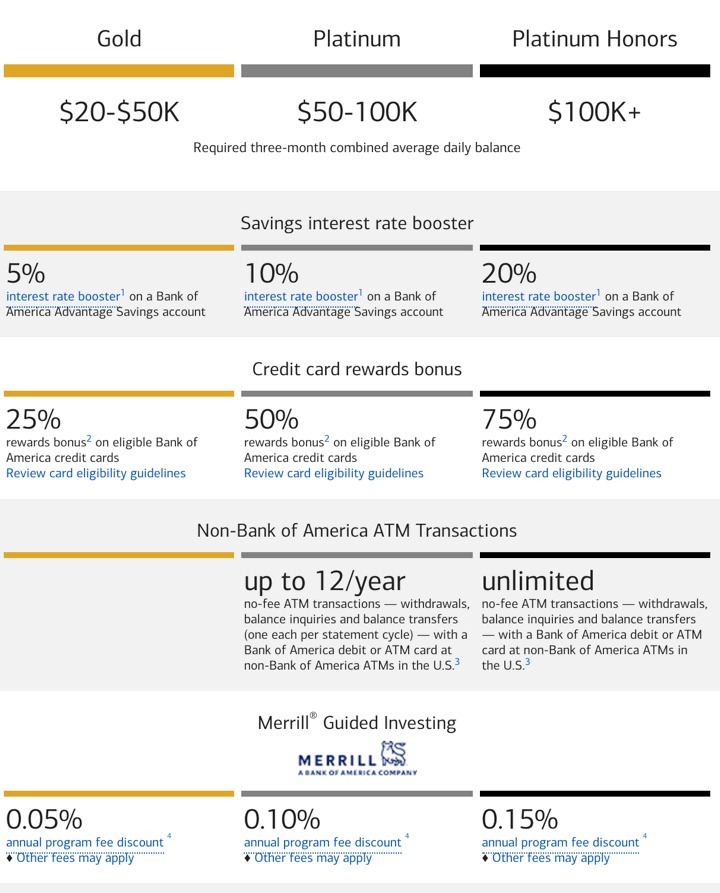

Bank of America - Preferred Rewards Program

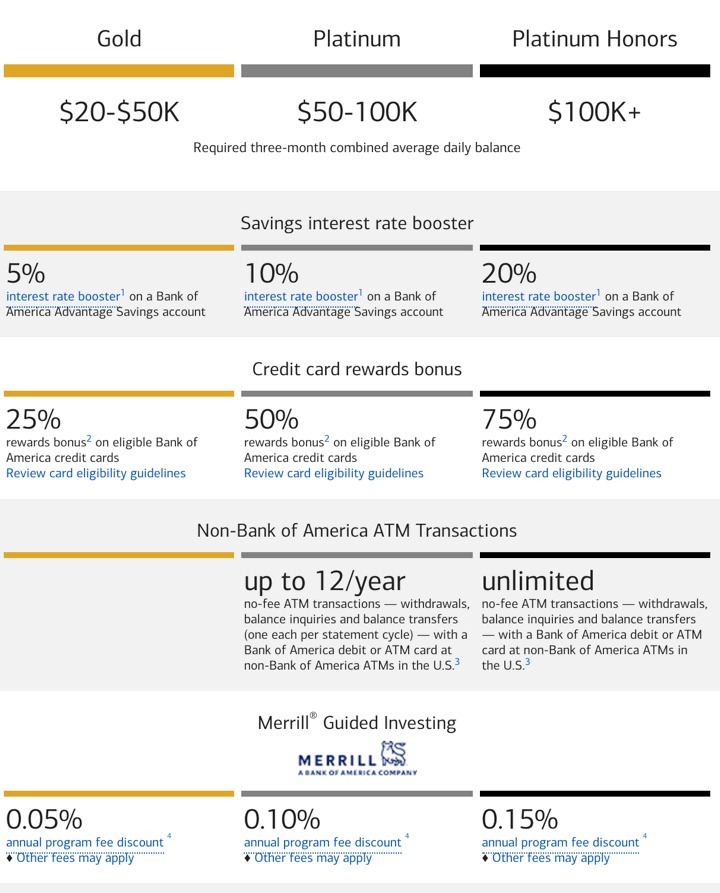

This multi-tier program offers substantial benefits based on account balance, making it especially attractive for high-net-worth individuals.

The program is divided into three levels:

- Gold ($20K-$50K balance)

- Platinum ($50K-$100K balance)

- Platinum Honors ($100K-$1M balance)

Key Features:

- Tiered Rewards: Customers in different tiers (Gold, Platinum, and Platinum Honors) receive benefits like higher savings interest and bonus points on credit card purchases.

- Cash-Back and Discounts: Members can also earn cash-back rewards, which can be redeemed at various retail outlets, restaurants, and airlines.

- ATM Benefits: Customers in higher tiers enjoy fee-free withdrawals at non-Bank of America ATMs.

This well-rounded loyalty program aims to reward customer loyalty by offering tailored benefits that enhance the banking experience, particularly for those with significant account balances.

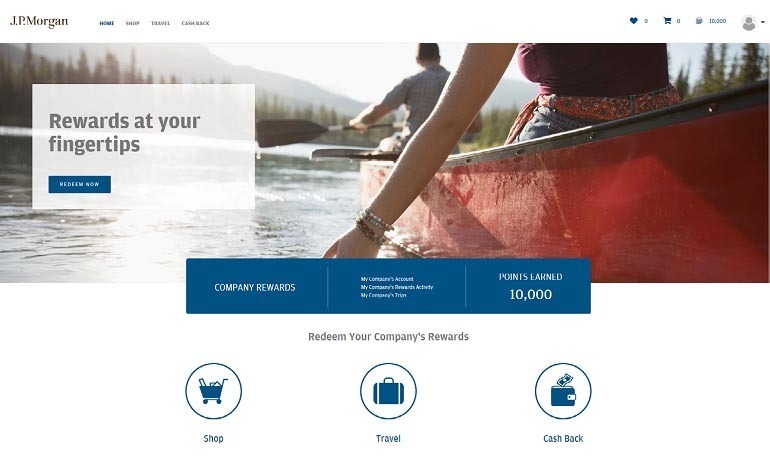

JP Morgan - One Card

JPMorgan Chase, the largest bank in the United States by total assets, is renowned not only for its expansive range of financial services but also for its significant influence on the global banking and investment sectors. With a strong presence in consumer, investment, and commercial banking, as well as asset management, JPMorgan’s financial standing is further bolstered by its well-regarded investment banking division. Its stock has performed impressively in recent years, reflecting its steady growth and

JPMorgan One Card Loyalty Program:

- Points Accumulation: The One Card program is a points-based system, where every dollar spent earns a reward point, making it simple for customers to track their earnings. This offers flexibility, as there's no cap on the number of points a consumer can accumulate, nor do the points expire, distinguishing it from many other programs that have stricter limitations.

- Redemption Flexibility: Points can be redeemed in various ways, including cash credit, travel rewards, gift cards, and merchandise. This range of options ensures that customers have the flexibility to choose rewards that suit their needs, whether they are looking to enjoy leisure perks or reinvest in their business.

- Bonus Points: For those who qualify, JPMorgan’s One Card offers enticing bonuses. For example, customers who spend $50,000 within the first three months of account opening can earn 25,000 bonus points. This is a notable perk designed to attract high-spending individuals and businesses.

- Fraud Prevention & Real-Time Reporting: The One Card loyalty program is tailored to provide enhanced security, especially for those who handle large amounts of money. Robust fraud-prevention measures are in place, and real-time reporting ensures that customers can stay on top of their points and transactions at all times.

- Targeted Toward High-Spending Customers & Businesses: While the program benefits individual consumers, it is particularly geared toward high-spending customers and corporate clients. The ability to reinvest points into business expenses or use them to reward employees further emphasizes the program’s appeal to enterprises and large-scale operations.

Overall, JPMorgan’s One Card loyalty program offers a comprehensive rewards system designed to cater to affluent individuals and businesses alike. With its flexible points system, attractive bonus opportunities, and extensive redemption options, it has become a standout in the world of bank loyalty programs, especially for those seeking both high-end personal and corporate benefits.

Silicon Valley Bank - SVB Rewards

Key Features of SVB Rewards Loyalty Program:

Gift Cards for Versatile Use

Charitable Donations

Prepaid Cards for Gifting

Luxury Items

Travel Perks

HSBC Rewards Program

About HSBC Rewards Program

The HSBC Rewards Program is designed to enhance the banking experience for its credit card customers. By using HSBC credit cards, cardholders can accumulate points for every eligible purchase they make. These points can then be redeemed for a wide variety of rewards that suit the lifestyle preferences of the customer, ranging from travel perks and merchandise to unique experiences and gift cards. The flexibility in redeeming rewards adds immense value for customers looking for convenience and customization.

Key Benefits and Features of the HSBC Rewards Program

Points Accumulation on Credit Card Spending

Flexible Redemption Options

Points Transfer to Airline Miles

Special Access to Discounts and Offers

Points Pooling for Families

American Express Membership Rewards

About American Express Membership Rewards

The American Express Membership Rewards program is highly regarded for its extensive and flexible rewards ecosystem, which allows cardholders to earn points on their purchases. These points can be redeemed across a variety of categories such as travel, shopping, dining, and unique, once-in-a-lifetime experiences, offering incredible value and versatility.

Key Benefits and Features of the American Express Membership Rewards Program

Flexible Redemption Options

No Expiration on Points

Points Transfer to Airline and Hotel Partners

Exclusive Amex Offers

Special Travel Privileges

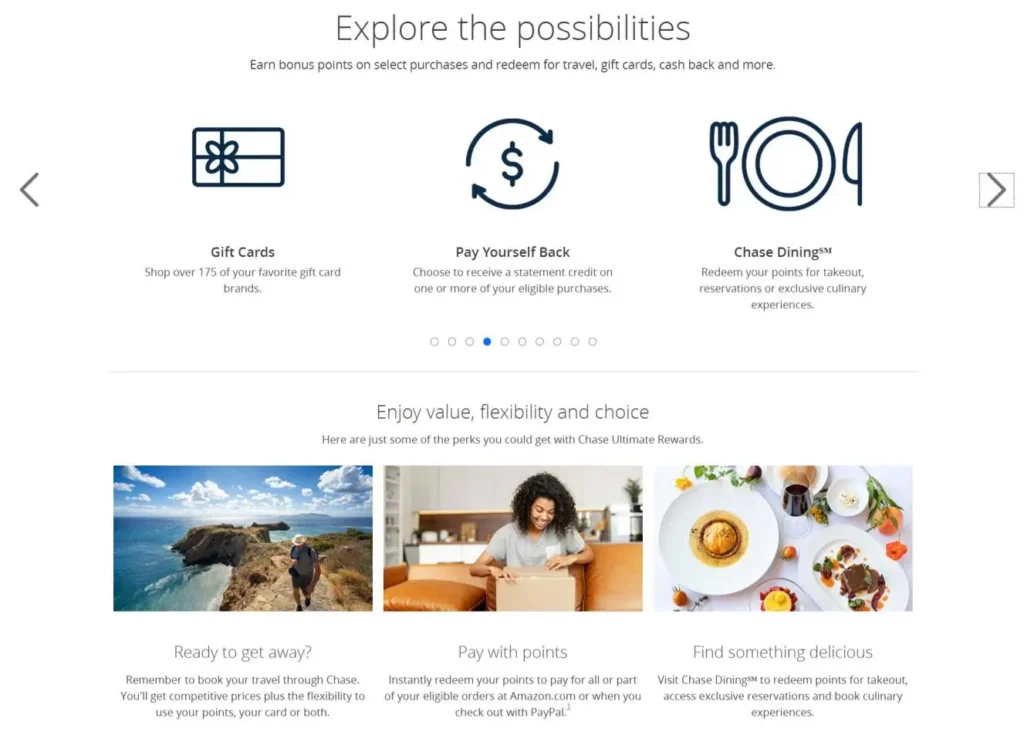

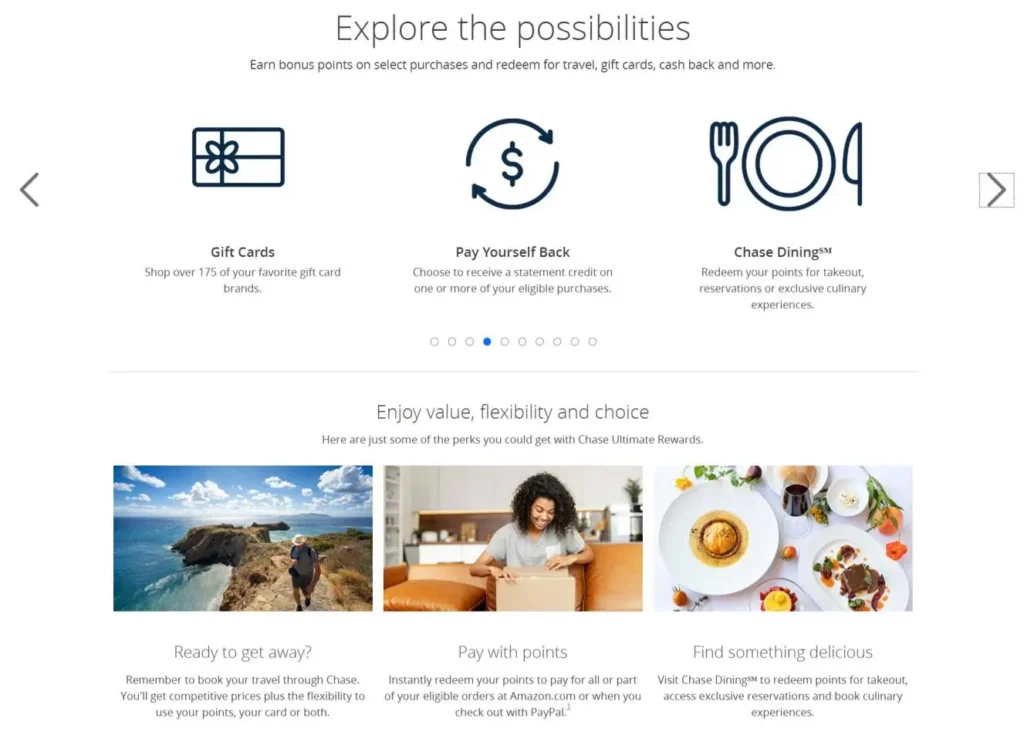

Chase Ultimate Rewards

About Chase Ultimate Rewards

The Chase Ultimate Rewards program is a highly flexible and valuable loyalty program designed to reward customers for their everyday spending. Points earned through the program can be redeemed for a wide variety of rewards, including travel, merchandise, gift cards, and cash back.

Key Benefits and Features of Chase Ultimate Rewards

Points on Everyday Spending

No Blackout Dates or Travel Restrictions

Transfer Points to Airline and Hotel Programs

Exclusive Access to Events

Premium Cardholder Perks

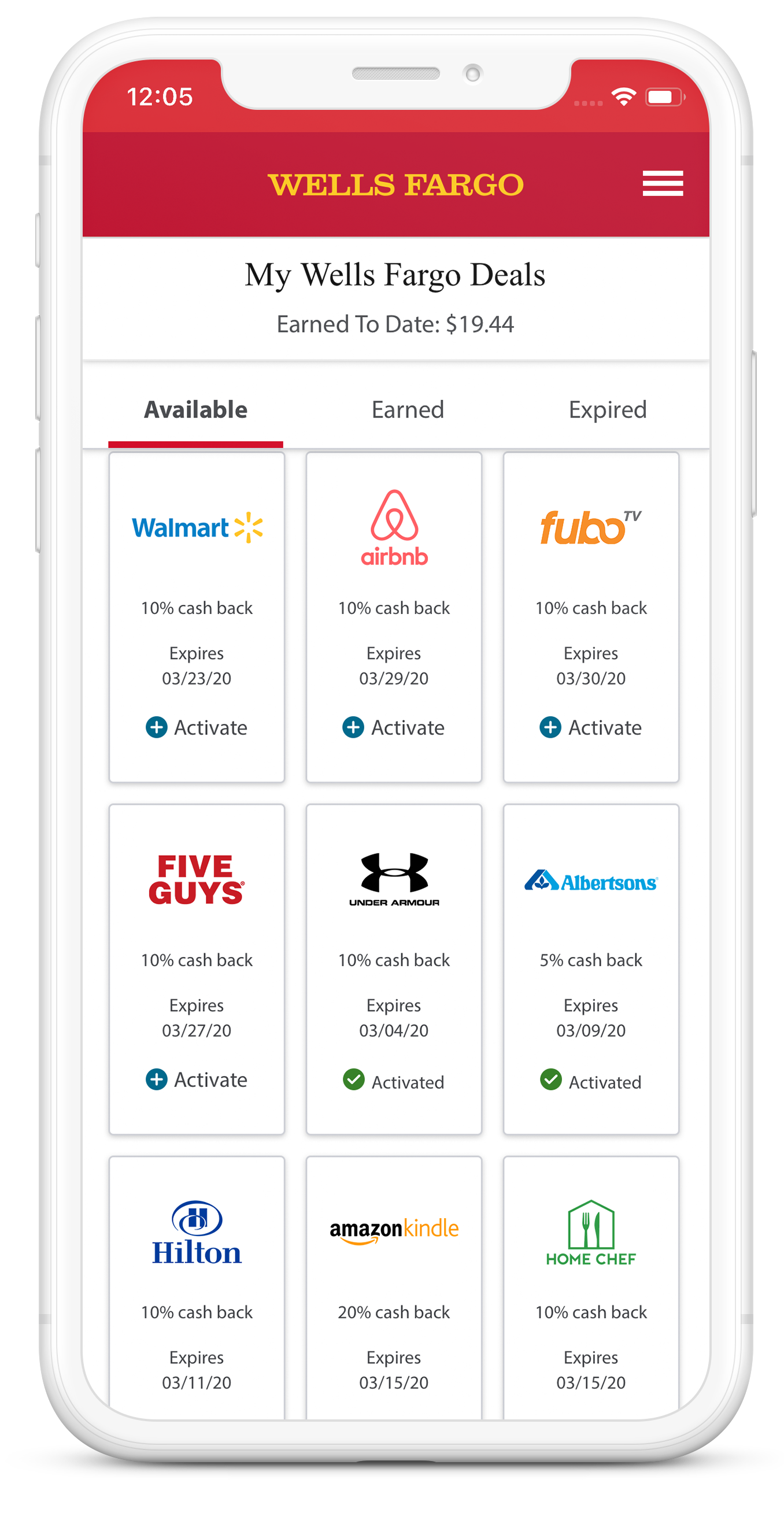

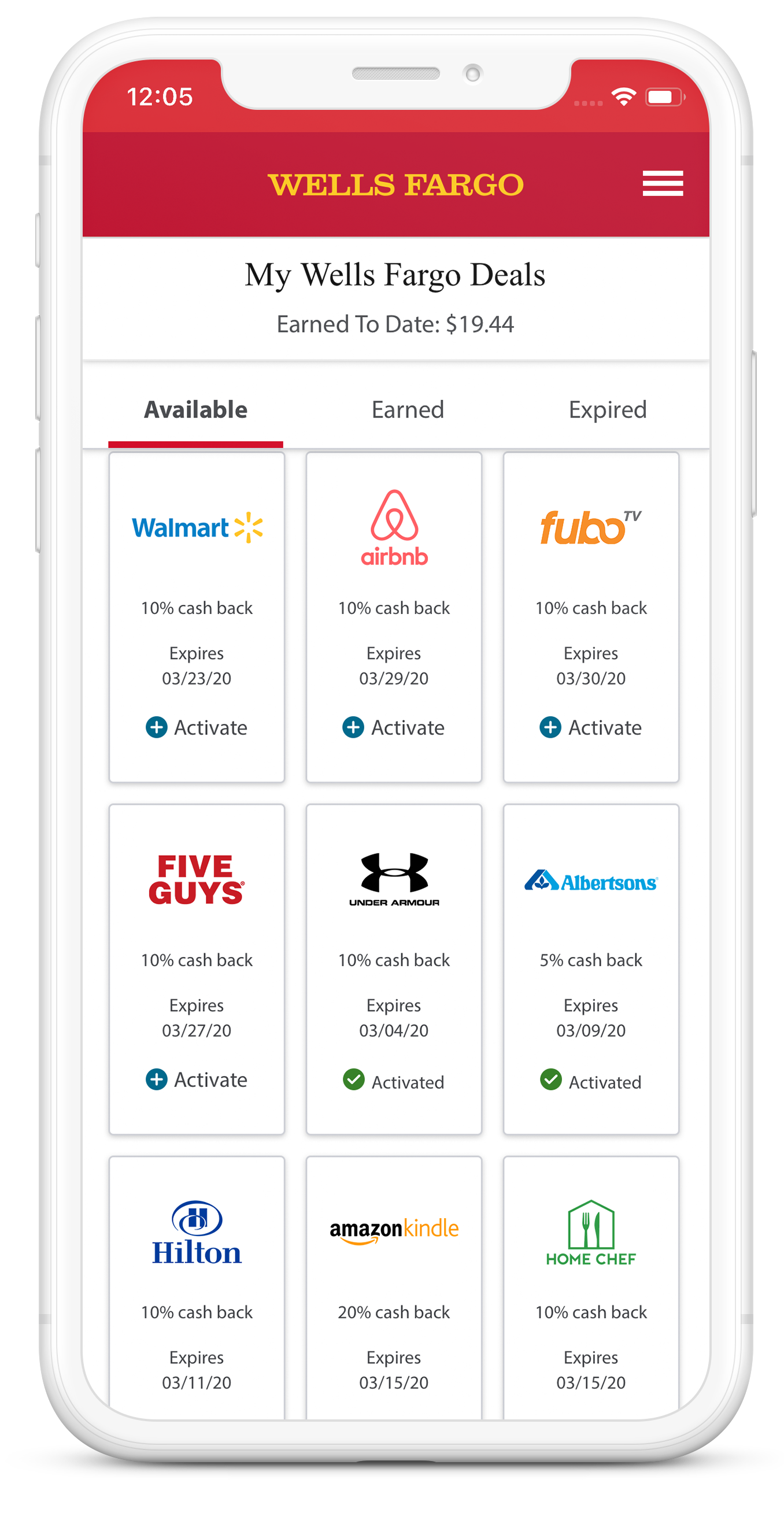

Wells Fargo Rewards

About Wells Fargo Rewards Program

Wells Fargo’s rewards program is available to customers holding its rewards-based credit cards. This loyalty program allows members to earn points on their purchases, with options to redeem rewards for gift cards, travel, purchases, or charitable donations.

Key Features of Wells Fargo Rewards Program

- Flexible Redemption Options: Points can be redeemed for various rewards such as purchases, gift cards, and travel bookings.

- Charity Donations: Customers can donate points to charities like the American Red Cross.

- Ease of Management: The program can be easily tracked and managed through the Wells Fargo online portal.

- Variety of Rewards: Rewards can be used across different categories, offering flexibility in how they are redeemed.

Wells Fargo’s rewards program offers a great way for cardholders to maximize their spending power while supporting their favorite causes or enhancing their lifestyle with rewards.

Barclays’ Blue Rewards program

About Barclays’ Blue Rewards Program

The Barclays Blue Rewards program is a subscription-based cashback loyalty program designed to give customers tangible rewards for their financial activities. By participating, customers can earn cashback on purchases made with selected retailers, as well as on banking services such as mortgages and loans.

Key Features of Barclays’ Blue Rewards Program

- Cashback on Purchases: Earn cashback on purchases at over 150 participating retailers.

- Broad Cashback Eligibility: Cashback applies to payments made with debit cards and certain financial products, including mortgages, loans, and insurance.

- Automatic Rewards Deposits: Rewards are automatically credited to your Rewards Wallet for convenient access.

- Subscription-Based Model: Access to the rewards program through a simple subscription, allowing for streamlined participation.

Barclays Blue Rewards enhances the value of everyday financial activities by offering customers flexible cashback options, providing an easy-to-use system for managing and utilizing rewards.

UBS Key Club Rewards

Key Features of UBS KeyClub Program

- Earning Points: Clients accumulate KeyClub points by engaging in banking activities such as using UBS credit or prepaid cards. For instance, spending CHF 100 with a UBS Credit or Prepaid Card (including cards in EUR/USD) earns 1 KeyClub point, with a maximum of 10 points per quarter.

- Redemption Options: Accumulated points can be redeemed through the KeyClub eStore for various rewards, including gift cards, travel vouchers, and merchandise. The eStore offers a diverse selection of products and services, allowing clients to choose rewards that align with their preferences.

- Partnerships: UBS collaborates with numerous partners, such as Manor, Zalando, and Apple, enabling clients to redeem points across a broad spectrum of retailers and service providers. This extensive network enhances the value and flexibility of the KeyClub program.

- Point Validity: KeyClub points are typically valid until December 31 of the following year, providing clients ample time to redeem their points. The specific validity period is indicated in the KeyClub eStore under "My account" > "Points balance."

- Accessing the eStore: Clients can access the KeyClub eStore directly through UBS e-banking by selecting "KeyClub" under the "Accounts and cards" menu. Alternatively, the eStore can be accessed via a direct link, requiring UBS e-banking login credentials.

The UBS KeyClub program offers clients a flexible and rewarding way to benefit from their banking activities, with a variety of redemption options and an extensive network of partners.

How to Measure the Success of a Bank Loyalty Program

Evaluating the effectiveness of bank loyalty programs is crucial to understanding their impact on customer satisfaction, retention, and profitability. By regularly measuring key performance indicators (KPIs), banks can assess the success of their rewards programs and identify areas for improvement. Tracking these metrics ensures that the programs remain attractive, relevant, and valuable to customers, driving long-term success for both the bank and its clients.

Here are the most important metrics that banks commonly use to evaluate the success of their loyalty programs:

Customer Satisfaction (CSAT)

Example of success: A consistent increase in CSAT scores over time indicates that customers find the rewards program valuable, leading to positive perceptions of the bank. High CSAT levels are a strong signal that the program is well-aligned with customers’ needs.

Retention Rate

Example of success: If a bank observes a high retention rate among rewards program participants, it suggests that the incentives offered resonate well with customers and that the program is playing a key role in customer loyalty.

Profitability per Customer

Example of success: If profitability per customer is higher among rewards participants compared to non-participants, it indicates that the program is driving profitable behavior, such as increased spending or account activity, making it a financially beneficial initiative for the bank.

Redemption Rate

Example of success: A high or increasing redemption rate suggests that customers perceive real value in the rewards, which in turn enhances the program’s appeal and effectiveness. It signifies strong customer engagement and program success.

Net Promoter Score (NPS)

Example of success: An increasing NPS indicates that customers are so satisfied with the loyalty program that they are willing to recommend it to friends and family. This organic word-of-mouth marketing is a powerful driver of customer acquisition and long-term retention.

Final words on Bank Loyalty Programs

Bank loyalty programs are key to building lasting customer relationships, driving satisfaction, retention, and profitability. By offering personalized rewards and tracking essential metrics, banks can continuously improve their programs to meet evolving customer needs.

For businesses looking to implement or enhance their bank loyalty programs, 99minds is a great choice. Their platform offers robust tools for creating tailored, engaging loyalty experiences that can help banks boost customer loyalty and long-term growth.

Frequently Asked Questions (FAQs) on Bank Loyalty Programs

What is a bank loyalty program?

A bank loyalty program rewards customers for their banking activities, such as spending on credit cards or maintaining account balances. Customers earn points or rewards that can be redeemed for various benefits like travel, cash back, or gift cards.

How do bank loyalty programs benefit customers?

Customers enjoy rewards for their spending, which can range from travel perks to discounts and exclusive offers, enhancing their overall banking experience.

How do banks measure the success of loyalty programs?

Banks track key metrics like customer satisfaction (CSAT), retention rate, profitability per customer, redemption rate, and Net Promoter Score (NPS) to evaluate the effectiveness of their loyalty programs.